Stock Trading App

Redefining Locate and Pre-Borrow Management in Finance

The Challenge

The inability to distinguish between a standard locate and a pre-borrow remains a persistent challenge—one that creates unnecessary complexity and exposes firms to avoidable compliance risks.

Current systems are heavy, expensive, and hard to implement. At the same time, the finance industry is facing a growing need for transparency, requiring a solution that streamlines workflows and keeps you ahead of regulation and risk.

The Vision

A team of Wall Street veterans, technologists, and market structure experts saw an opportunity to redefine how the financial industry handles short selling and securities lending. Their goal was to create a portal that would serve as a central hub for locates that must be secured before executing a short sale.

However, this great—yet complex—idea required custom software development, leading Scopic to join the project.

The Scopic Solution

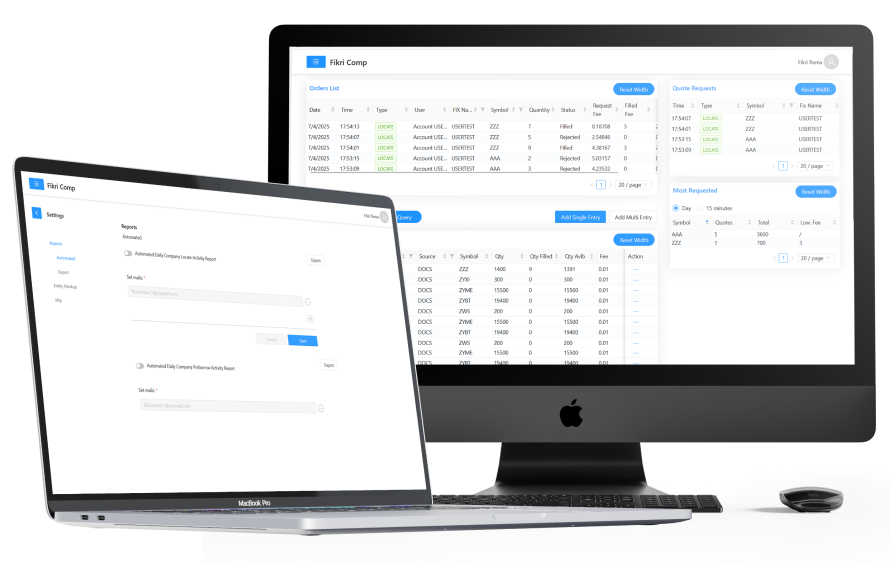

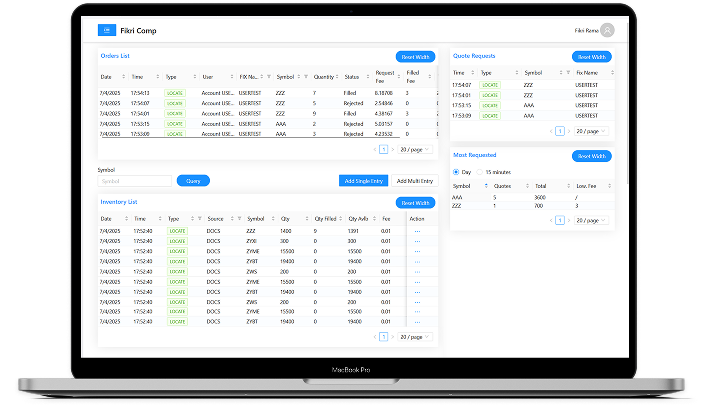

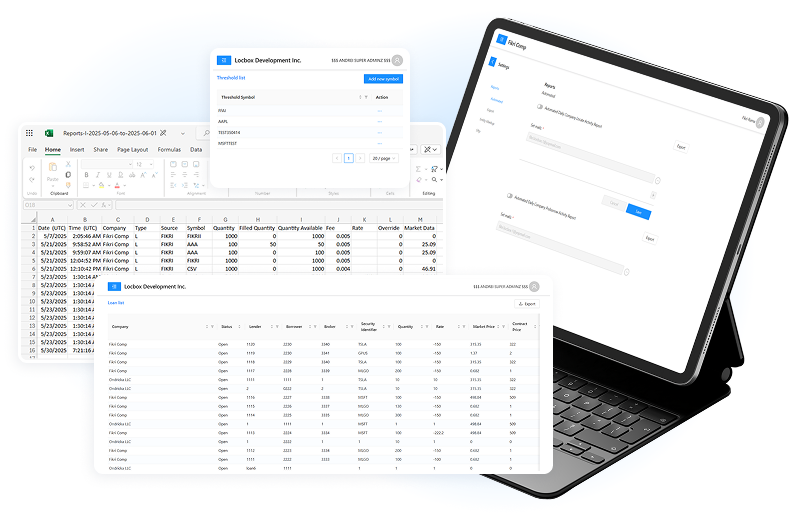

Our team developed LocBox, a web-based stock loan inventory management platform that’s now recognized as being the only solution that separates locates from pre-borrows. We implemented various features—such as automated reporting, real-time risk monitoring, and symbol lookup and quote requests—while working closely with the founders to ensure compliance and alignment with their strategic objectives.

The result is a platform that makes it easy to document, track, and manage pre-borrow activity in real time, enabling seamless integration and detailed reporting.

With transparency as the foundation of this solution, LocBox is the key to trading smarter. To ensure long-term success, our team continues to work with the client to implement new features and improvements as their business grows.

Symbol lookup and quote requests

Bulk symbol import

Favorites and threshold tags

Automated reporting

Real-time risk monitoring

User role/type management

In-app navigation